Why You Need Financial Intelligence As A Business Executive

Money is a phenomenon that cuts across many human engagements directly or indirectly; and as regards business, economy or commerce, it is the focal point or rudder that stirs conversations, transactions, and determines operations and engagements.

Despite directly or indirectly influencing the day-to-day narratives of humans across cultures, classes, and demographics, understanding the dynamics of money or obtaining financial intelligence is not a natural endowment but a skill that must be accessed through intentional learning.

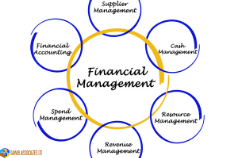

A typical organization has sectors or departments that fall into the financial or non-financial, but as a manager, it is imperative to note that events around the business world have heightened the demand for financial intelligence to be part of a manager’s skill set.

It is no longer good enough for organizations aiming towards growth and expansion to have leaders who lack financial integrity and a good degree of financial competence. The need for good management now forbids the inability of a manager to understand financial terms or keep poor accounting records, waiting for the accountants to clear the mess.

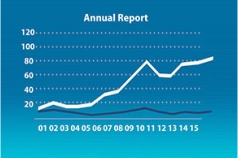

A manager should be able to read, comprehend and utilize information contained in a monthly or yearly financial report so as to make sound decisions or have a vivid picture of the company’s reality.

Business is about money, not having a basic financial intelligence puts you out of business or at the mercy of those that have.

This does not mean that every business leader must be an accountant, or have grand knowledge of finance and accounting, but to effectively run a money oriented firm, one must have a respectable knowledge of the dynamics and management of money.

As business gets more competitive or warlike, and an organization becomes more global and technologically driven, finance and accounting are having more impact on organizations more than the ways managers outside the finance department thought of it.

According to Gene Siciliano,“Today we are finding out that we need to know how to read report cards so we can keep our jobs, let alone advance in our careers. Board of directors now need to delve into the reports they have routinely received for years to a degree never before contemplated.

They need to understand financial terms and accounting methods they might previously have taken for granted. CEOs now need to be completely aware of what their people are doing and the financial ramifications, because they will no longer be able to credibly say they don’t know. And finally, managers within a company, whether large or small, are going to need to understand the rules of accounting and the boundaries of proper finance well enough to avoid getting into trouble just because they were aggressively trying to make their goals. As for those who aspire to become managers, they might not even get started up the ladder until they can demonstrate this kind of knowledge.â€

Misconceptions about Financial Accounting

Before delving into simple explanation of some accounting and finance jargon, you need to understand that effective financial literacy as a non-financial manager doesn’t mean rocket science rather just a demand of genuine willingness to afford a vital learning towards your career and organization’s growth.

You must unlearn some myths and fears about accounting and finance such as the misconception of arithmetic in accounting; many people think that accounting is about some kind of advanced arithmetic that demands being a genius. Well, almost all of accounting involves nothing more difficult than addiction, division, subtraction, multiplication – and these are basically elementary mathematics.

Moreover, financial literacy is not same as being an accountant. You don’t need to run systems, record transactions, interpret and apply standards, balance ledgers, assemble data and present it in a formal accounting pattern. Financial literacy is basically about being able to read and understand what is written in a financial statement and draw conclusions or make decisions based on the information.

The accounting knowledge that is needed to be financially literate is the basics which are simple. That means a manager without much effort can get most of what he or she wants in understanding financial statements and making decisions based on the conclusions drawn from the information.

Don’t also be scared of the terminologies; as usual, different fields have jargon with which they use to effectively communicate their ideas, concepts and occurrence. Accounting is no difference, but you need to realize that the jargon are just customized terms for basic concepts. Below are some basic accounting terms and simple explanations.

Accounting Terminologies

ACCOUNTING: this is the recording and reporting of all of a company’s financial transactions which includes book keeping, analyses and reporting.

GAAP: The rules, regulations and standard procedures for reporting financial information as stipulated by the financial accounting standards boards.

BALANCE SHEET: a financial statement that summarizes a company’s value and debt at a given period of time.

ASSETS: something with an economic value that is owned by a company that aids it in manufacturing products or generating operating revenue. This includes physical equipment or land; could also be of intangible value such as reputation or brand identity.

- Non-Current assets: also known as long-term assets, this type of assets or investments are not acquired to be turned into cash in a period of 12 months, rather to be used in conducting the business. Non-current assets can be tangible or intangible

- Tangible: this refers to assets that exist physically such as land, machinery, vehicles etc.

- Intangible: this type of non-current assets are those that though possess economic value and are identifiable, but don’t exist physically. Examples include corporate intellectual properties like trademarks or patents.

- Current Assets: A type of assets that are cash or can be converted into cash on or before an estimated time of 12 months.

- Accounts Receivables: This is the amount owed to the company by customers as a result of sales made on credit.

- Inventories: this refers to products or items manufactured or purchased by a company for the purpose of sales.

- Prepayments: When expenses are paid in advance, thereby allowing the business not to pay such money again in the next one year it is known as prepayment. This included property taxes, insurance etc.

EQUITY: naturally the source of fund to acquire the resources with which to run the business with, equity is basically the calculated amount that is retained when liabilities are subtracted from assets.

Share Capital: this is the total value of funds raised by a business by issuing shares to shareholders.

Retained Earnings: This is part of a company’s net income or profit that is not paid out as dividends to the business owner(s) or stockholders, rather retained to be reinvested into the business to fund future projects, pay off debts, or even buy out other companies.

LIABILITIES: This is basically debts; the amount that a company owes and expected to pay.

Non-Current Liabilities: when a business has long-term financial obligations that exceeds the period of 12 months before it is due for settlement, it is known as non-current liability. Examples include debenture, long-term loans, deferred compensations or tax liabilities.

Currents Liabilities: these are debts expected to be paid by a company in an estimated period of 12 months. This includes:

- Account Payable: This is the account that holds all bills or debts yet to be paid for by the company towards her service providers or suppliers etc.

- Accrual Expenses: these are expenses that have been incurred and recognized as at the time of its occurrence, even though cash payment has not been made to that effect.

INCOME STATEMENT: also referred to as operating statement, it is the accounting of profit, revenue and expenses over a given accounting period.

Revenue: This is the total value a business generates from the sales of her goods or services, or even from the use of her assets, before deductions like cost of sales, operating expenses or taxes are deducted.

Expense: this is the amount spent or cost incurred by a business in its normal day to day operation to generate revenue, otherwise known as the cost of doing business.

Direct cost: This is a type of expense that can be easily identified directly to the cost object or expenditure.

Indirect Cost: This is the type of cost whereby it is challenging to trace the cost specifically to the cost object due to joint usage or multiple cost objects associated with a particular expense. For instance, rent or advertising.

Depreciation: the amount by which something, such as an equipment is reduced in value and in a company's financial accounts over the period of time it has been in use.

Amortization: this is the process of spreading the cost of an intangible asset over its expected useful life.

Gross Profit: this is the amount that a company earns after sales of product or services, and payment of the cost of providing the services or manufacturing the product.

Net Profit: After a company has sold its products or rendered services, and paid off the expenses of the business, the amount left of the earnings is the net profit.

EBITDA: stands for, earnings before interest, taxes, depreciation and amortization. It is a financial measure for evaluating a company.

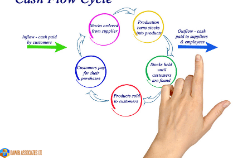

CASH FLOWÂ STATEMENT: This report contains the effects of all transactions that involved cash but was not featured on the income statement.

Operating activities: These are basically activities that directly affect a company’s cash flow and decide her income.

Investing Activities: These are transactions, whether for sales or purchase of assets that are not meant for immediate resale.

Financing Activities: these are activities or initiatives adopted by a business to actualize her economic goals.

BUDGET: this is a forecast of detailed income and expenses that are estimated to happen in the future.